Stablecoin cross-border payments offer a fresh alternative for global payments, combining the security of blockchain with a price that doesn’t fluctuate like regular cryptocurrencies.

With stablecoins, you get clear fees, quick transfers, and the power to send funds almost anywhere.

How Traditional Cross-Border Payments Work

Most people are used to sending money internationally through banks or well-known money transfer companies.

Traditional cross-border payments may seem straightforward, but a lot is happening behind the scenes that can slow things down and increase costs.

Intermediary Banks and Payment Networks

When someone sends money abroad using a bank, the payment rarely travels in a straight line. Instead, it often passes through a series of intermediary banks, also known as correspondent banks.

Each bank in this chain takes a fee for processing the transaction.

SWIFT Messaging and Processing Delays

Banks coordinate international transfers using the SWIFT messaging network.

While SWIFT is highly secure, it’s not instant.

Each message is a request to move funds from one account to another, and there may be delays at every step due to manual checks, compliance reviews, and time zone differences.

Transparent? Not Exactly

Traditional payments often lack transparency. When sending money, it’s common to wonder:

- How much will actually arrive?

- How long will it take?

- What are all these mysterious fees?

Fee Structure and Exchange Rate Markups

The full cost of a cross-border payment goes beyond the advertised transfer fee. You may also get hit with:

- Exchange Rate Margins: Banks rarely use the real, mid-market exchange rate. Most add a markup that isn’t always clear up front.

- Third-Party Fees: Each intermediary in the chain may deduct fees, shrinking the final amount your recipient receives.

Who Uses These Methods?

Businesses, freelancers, and everyday consumers still rely on these traditional payment rails for a range of reasons, from paying vendors to receiving freelance wages.

Common Drawbacks of Traditional Payments

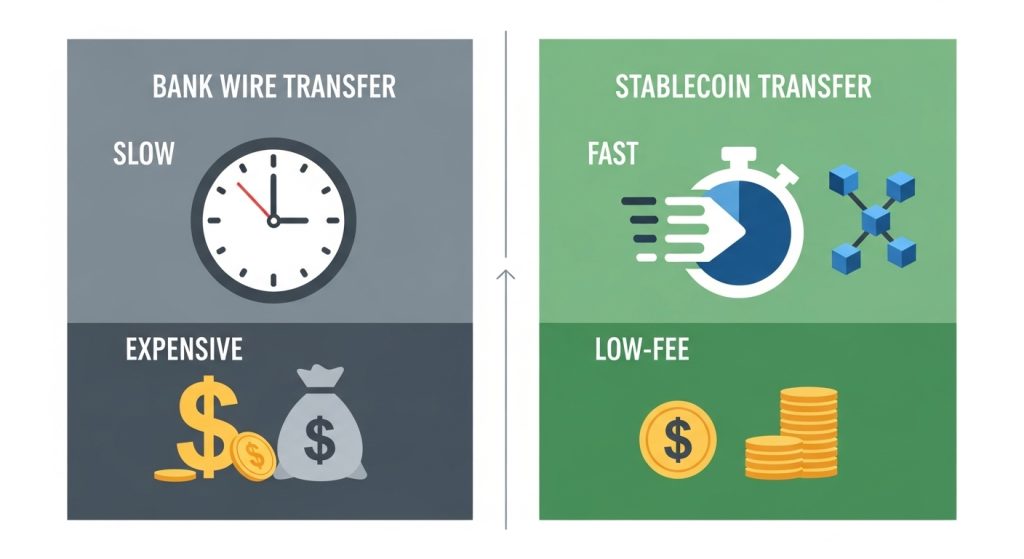

Let’s quickly sum up the biggest pain points:

- Slow processing times, often several business days

- Unclear or stacked fees that reduce the final payout

- Limited transparency throughout the process

- Exchange rate markups that don’t favor the sender or the recipient

Stablecoins: A New Era for Global Transactions

Stablecoin cross-border payments are changing the way people move money across borders. Instead of waiting days for payments to clear or losing chunks of money to hidden fees, users can now send digital dollars at the speed of a text.

Real-World Usage: Freelancers, Small Businesses, and Remittances

Fixed-value crypto isn’t just a buzzword.

They’re solving real problems for real people.

For freelancers, a project payment from a client on another continent can land in your pocket the same day.

Key Benefits of Using Stablecoins for Cross-Border Payments

Stablecoin cross-border payments are quickly becoming the go-to tool for sending money around the globe.

For freelancers, small businesses, and digital nomads, these digital assets offer a modern shortcut—cutting out the expense and headaches of banks.

Cost Savings and Efficiency Gains

Nobody likes losing money to fees or waiting days for a payment to arrive.

Stablecoin cross-border payments skip the middlemen, which means fewer parties taking a cut and less red tape slowing things down.

Security, Transparency, and Accessibility

Stablecoins aren’t just about saving money.

They also bring better transparency and security to the payment process, which builds trust and confidence for everyone involved.

Risks, Regulation, and the Future of Stablecoin Cross-Border Payments

Stablecoin payments can make moving money across borders faster, cheaper, and more transparent, but they are not problem-free.

Anyone using or considering stablecoin transfers should know the risks, keep an eye on global regulations, and watch how this technology might change in the near future.

Risks of Using Stablecoins in Cross-Border Payments

Stablecoins are built for stability, but issues can still pop up. The most common risks include:

- Counterparty risk: Most stablecoins like USDT (Tether) or USDC (Circle) are supported by companies that promise your coins are backed by real-world assets.

- Regulatory uncertainty: Different countries treat stablecoins differently. Some may ban them, limit their use, or change rules overnight. This can leave you unable to cash out or even receive funds.

Stablecoin Regulation: What You Need to Know

Regulation is moving fast in the world of stablecoins and could shape the way teams pay and get paid across borders.

Here’s what users should watch for:

- Licensing and compliance requirements: Governments are starting to require stablecoin issuers and service providers to register, complete KYC (know your customer) checks, and follow strict guidelines.

- Limits on transfers and use: Some countries cap how much you can send or receive in stablecoins, or require a clear link to real-world identity.

- Taxation and reporting: Authorities are paying close attention to stablecoin transactions.

The Future of Stablecoin Cross-Border Payments

With more people and companies turning to stablecoins, what’s next?

Expect these trends to shape the payment landscape:

- Greater government involvement: Central banks and regulators may introduce their own digital currencies, competing with private stablecoins or integrating them into the banking system.

- Innovation in on/off ramps: More local payment apps and exchanges are offering instant swaps between stablecoins and cash, even for tough-to-reach regions.

- Shift to transparency and user-protection: New services will focus on detailed tracking, instant receipts, and easy dispute resolution.

Conclusion

Traditional cross-border payments offer a practical choice for freelancers, small business owners, and digital nomads looking to save time and money when sending funds worldwide.

Choosing reliable providers and keeping up with changing rules matters as much as the tech itself.

Since the space is always evolving, staying informed helps you avoid surprises and make smarter moves with your money.

For more tips, app guides, and breakdowns of the best P2P tools out there, browse our Listicles on PayAPeer for fresh insights.