Stablecoin payments are changing the way people send and receive money worldwide.

For freelancers, small businesses, and digital nomads, they offer a simple way to accept payments from anywhere, without the frustration of high fees or bank delays.

What Are Stablecoins? Key Features and Use Cases

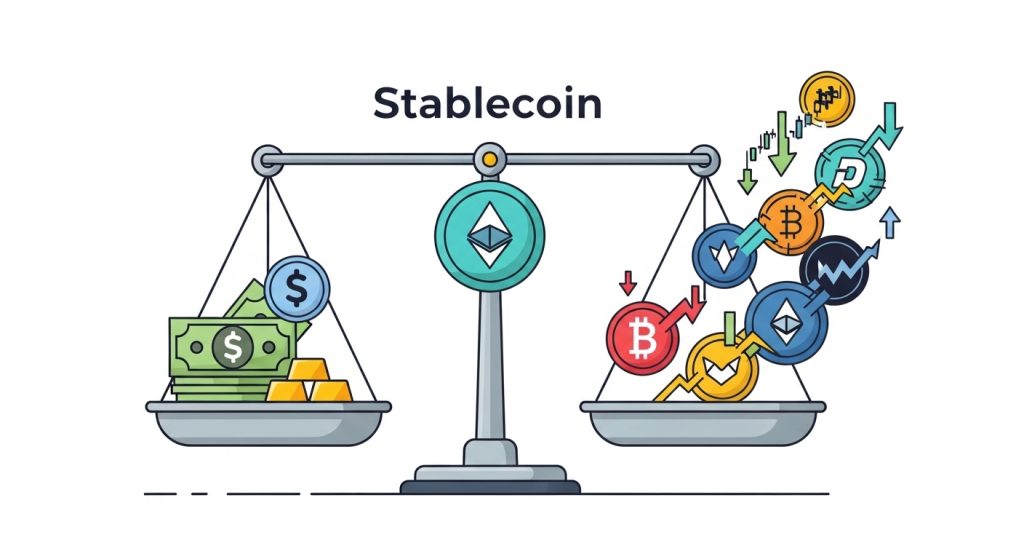

Stablecoins are a unique type of cryptocurrency designed to keep their value steady, unlike most digital coins that can rise or fall in price overnight.

Instead, stablecoins are pegged to stable assets, such as US dollars or gold, offering the peace of mind people need for day-to-day spending and business.

Main Features of Stablecoin

- Price Stability: The key draw of a stablecoin is its consistent value. Most are tied to the US dollar or another major currency.

- Low Transaction Fees: Sending stablecoins usually costs less than wire transfers or even many digital wallets, especially for cross-border deals.

- Fast Settlements: Payments arrive within minutes, sometimes seconds. This can be a game-changer for freelancers and businesses tired of bank slowdowns.

Common Use Cases for Stablecoin

- International Payments: Small businesses and freelancers can accept USD-pegged stablecoins from clients worldwide, making it easier to price services and avoid surprise fees.

- Payroll and Remittances: Companies pay remote workers, and expats send money home instantly and for less, all without costly middlemen.

- Peer-to-Peer Lending: Platforms now let users lend and borrow funds directly with stablecoins. This can make lending accessible and fast, with lower risk for both parties.

Benefits of Using Stablecoin Payments

Stablecoins give people and businesses a smarter way to send, receive, and manage money.

By keeping fees low and offering quick access to funds, stablecoin payments are pushing past old barriers often set by banks and traditional payment services.

Lower Transaction Fees and Fast Settlement

Paying with stablecoins usually costs much less than wire transfers or competing payment processors.

Traditional international payments often hit you with hidden conversion fees, flat charges, or percentage cuts on every transfer.

Key advantages at a glance:

- Tiny processing fees compared to wire and bank transfers

- Near-instant transfers for fast business cash flow

- Fewer middlemen, so you keep more of your earnings

Financial Inclusion for the Unbanked

Stablecoin payments are opening financial doors for people who have been shut out by banks or live in places with unreliable currencies.

More than a billion adults worldwide are unbanked, meaning no easy access to open a bank account, cash a check, or get a loan.

Risks and Challenges in Stablecoin Payments

While stablecoin payments solve many problems found in traditional finance, they come with their own set of risks and challenges.

Staying alert to these issues is key when sending, receiving, or holding value through digital coins.

Regulatory Uncertainty and Legal Risks

The rules for digital currency can change quickly, and not all countries agree on how to treat stablecoins.

Some regions have created clear rules, but many are still figuring out how stablecoins fit into existing laws.

Platform and Security Vulnerabilities

Relying on stablecoins means trusting both the technology and the platforms behind them.

Security risks can take many forms:

- Wallet hacks: If your wallet provider isn’t secure or you fall for a phishing scam, your funds may be lost for good. Remember, stablecoin transactions are not reversible.

- Smart contract bugs: Many stablecoins and the apps that use them rely on smart contracts (automatic programs on the blockchain).

- Issuer failures: Some stablecoins depend on companies to keep enough real money in reserve.

Keeping Stablecoins Safe

Here are some quick tips to keep your stablecoins safe:

- Use strong, unique passwords for wallets and accounts.

- Enable two-factor authentication to block unauthorized access.

- Keep your wallet backup phrases offline and never share them.

How to Accept and Use Stablecoin Payments

Accepting stablecoin payments is easier than ever, even if you’re new to crypto.

With a bit of setup, you can get paid by clients worldwide, store your earnings in a stable, digital format, and spend or convert your money when you need.

Setting Up a Stablecoin Wallet

To receive stablecoin payments, you’ll need a digital wallet that supports popular stablecoins like USDT, USDC, or DAI.

Think of this wallet as your digital checking account, where you can send, receive, and hold your funds securely.

To Get Started:

- Choose a reliable wallet: There are many free wallet apps available, such as Trust Wallet, MetaMask, or Coinbase Wallet. Pick one that fits your devices and comfort level.

- Create and back up your wallet: Follow the wallet’s setup process. You’ll receive a “seed phrase” or recovery phrase—write this down and store it safely offline, as it’s your key to accessing your funds.

- Enable security features: Set a strong password and, if possible, add two-factor authentication.

Receiving Stablecoin Payments

Accepting payments is simple once your wallet is ready.

Give your client or customer your wallet address, making sure you confirm the right stablecoin and network (some coins exist on more than one chain).

Common Payment Flow

- Agree on payment terms and coin (e.g., USDC on Ethereum).

- Share your wallet address by copying and pasting from your app.

- Have your client send the funds.

Converting and Using Stablecoins

Once funds arrive, you have flexible options. You can hold stablecoins for future payments, trade them for local currency, or spend them directly where accepted.

Popular Ways to Convert Stablecoins

- Crypto exchanges: Platforms like Binance, Coinbase, or Kraken let you swap stablecoins for your local currency or other cryptocurrencies.

- Payment cards: Some companies provide cards that let you spend stablecoins anywhere debit cards are accepted.

- Invoicing tools: Online platforms like Request or NOWPayments make it easy for businesses to send invoices, automate conversions, and keep track of payments.

Best Practices for Secure and Smooth Payments

Stablecoins are fast, but a few good habits can help you avoid mistakes or lost funds:

- Double-check wallet addresses before sending or sharing. Crypto transactions cannot be reversed if you use the wrong address.

- Clarify the stablecoin and network with your payer. For example, “USDC on Ethereum” is not the same as “USDC on Solana.”

- Track all payments and withdrawals. Keeping clear records will help with taxes and bookkeeping.

Opportunities for Freelancers and Small Businesses

Stablecoin payments are opening doors for freelancers and small businesses in ways traditional banks and payment apps simply can’t match.

More creators, consultants, and entrepreneurs are discovering real benefits when moving to stablecoins, from skipping sky-high fees to landing global clients with ease.

Global Client Access Without Borders

Freelancers who accept stablecoins break free from limits that local banks often create.

You can work with clients in any country and get paid in minutes. No more waiting for slow wire transfers or dealing with confusing international forms.

Lower Costs Improve Your Bottom Line

Every dollar counts for small businesses and freelancers.

Bank charges, wire fees, and even payment app commissions can eat away at your income. Stablecoins often keep the cost to send or receive payment under a dollar, even for international transfers.

Fast, Reliable Payouts

Table: Stablecoin Payments vs. Traditional Methods

| Feature | Stablecoin Payments | Traditional Banks |

|---|---|---|

| Speed | Minutes | Several days |

| Fees | Low | Often high |

| Cross-border Use | Yes | Often limited |

| Availability | 24/7 | Bank hours |

Business Flexibility and Modern Client Appeal

Many tech-forward clients now expect or prefer digital payments.

Being able to accept stablecoins can help freelancers and businesses win new clients who value fast, transparent, and global-ready payment options.

Increased Security and Fewer Payment Disputes

Stablecoin transactions are recorded on public blockchains, so every payment has a traceable history.

This transparency can cut down on disputes or missed payments, building trust between freelancers and their clients.

New Avenues for Earning and Lending

Stablecoins aren’t limited to payments alone.

Many freelancers and small businesses are now exploring P2P lending and passive income from digital assets, creating new streams of revenue beyond client work.

Conclusion

Stablecoin payments give freelancers, small businesses, and digital nomads the tools to move money faster, pay less in fees, and open new doors to global clients.

They offer stability and invite people into peer-to-peer economies who were once locked out by banks or unstable currencies.

But every new tool comes with responsibilities, staying informed about security and shifting rules matters.

By exploring guides on safe peer-to-peer payments and best practices, users can build smart habits from the start.