Peer-to-peer money transfer is the process of sending funds directly from one person to another, without going through a bank or traditional payment service.

With more freelancers, small business owners, and digital nomads working and living from anywhere, fast and secure transfers have become essential.

What is Peer-to-Peer Money Transfer?

Peer-to-peer money transfer, often referred to as P2P transfer, allows you to send funds directly from your account to someone else’s without a bank acting as the intermediary.

Instead of mailing checks or filling in wire transfer forms, you can pull out your phone or log into a web platform and send money with just a few taps.

How Peer-to-Peer Money Transfer Works

Think of a P2P transfer as a digital handshake.

Two people agree on a payment, then use an app or platform to move funds.

These systems work in a few steps:

- User adds payment details: You sign up, link a card, bank account, or digital wallet.

- Enter recipient info: The sender selects who to pay, often using a phone number, email, or unique ID.

- Enter amount and send: You type in the amount and confirm the transfer; the money usually moves in seconds or minutes.

Traditional vs. Digital P2P Systems

P2P money transfers existed long before smartphones, but today’s technology makes sending money across a city or across the world a quick, everyday task.

- Traditional systems: These include cash handoffs, checks, and even old-school bank transfers. They’re often slow, require paperwork, and only work during banking hours.

- Digital P2P platforms: Apps like Venmo, Cash App, PayPal, and even crypto wallets connect to your device for 24/7 access. They offer instant or near-instant payments, often with lower fees and better tracking.

Why Peer-to-Peer Money Transfers Are Growing

People send money peer-to-peer for the same reason we use text messages over letters: it’s fast, easy, and direct.

Benefits of Peer-to-Peer Money Transfer for Modern Users

Peer-to-peer money transfer platforms offer major perks for those constantly on the move, running businesses, or managing freelance work.

With a focus on speed, lower costs, and robust security, these tools fill the gaps left by banks and traditional payment systems.

Here’s how these features directly benefit freelancers, business owners, digital nomads, and everyday savers.

Fast and Convenient Transactions

One of the biggest wins with peer-to-peer money transfer is speed.

Most platforms let you send or receive money instantly, whether it’s day or night.

You don’t have to work around bank hours or wait days to see funds hit your account.

Reduced Fees and Accessibility

P2P platforms usually slash the fees that banks add to transfers, which saves money over time.

Many services keep costs low by cutting out middlemen and avoiding high currency exchange charges.

Enhanced Security Features

Security is top-of-mind whenever money changes hands online.

Peer-to-peer money transfer platforms invest heavily in strong safety features that protect both your money and your personal details.

Types of Peer-to-Peer Money Transfer Solutions

When you need to move money directly to someone, whether it’s a friend, contractor, or vendor.

You’ll find several types of peer-to-peer money transfer solutions to choose from.

Your options range from old-school bank systems to modern payment apps and even decentralized crypto tools.

Traditional Bank-Based P2P Transfers

Bank-based P2P transfers have been around for years. Zelle is the most well-known of these services, built into the apps and websites of many major banks.

You send money using only the recipient’s email or phone number, and the funds move from one bank account to another—no extra accounts needed.

How it works:

- Most users access Zelle right inside their existing banking app.

- Transfers happen quickly, often within minutes if both parties’ banks support Zelle.

- No new login or download is required for folks with a participating bank.

Limitations:

- Only works with banks that have integrated the service.

- If your recipient’s bank isn’t supported, transfers can be slower or less reliable.

- You may hit daily or monthly sending limits.

- International transfers typically aren’t available.

Digital and Mobile P2P Payment Apps

Digital and mobile apps have changed how we send money.

Apps like PayPal, Venmo, and Cash App have millions of users.

These platforms are fast, flexible, and designed for busy people.

Standout features:

- Easy sign-up and linking to debit cards, bank accounts, or even prepaid cards.

- Simple user interfaces; sending money is as easy as sending a text.

- App-based notifications and social feeds (Venmo shows a payment activity feed, which some love for its community feel).

How they compare:

- PayPal: Known globally, supports payments in multiple currencies, and is a go-to for many online freelancers and shoppers.

- Venmo: Popular in the US for quick person-to-person payments, social-style payment notifications.

- Cash App: User-friendly, offers instant deposit, and even supports Bitcoin transfers.

User experience:

- Most transactions are instant or nearly so.

- Apps work across devices and often don’t care which bank you use.

- Fees are usually low, but can apply for instant transfers or credit card payments.

Web3 and Crypto Peer-to-Peer Transfers

Web3 and crypto P2P transfers give you something banks and typical apps never could: complete ownership and a chance to send money anywhere, anytime, with almost no borders.

What makes them different:

- Use blockchain-based wallets (like MetaMask or Coinbase Wallet) for direct transfers.

- Funds move via decentralized networks, skipping banks or corporate intermediaries.

- You control your own wallet and keys.

Key benefits:

- Great for global transactions, send funds anywhere the internet reaches.

- Lower fees for cross-border payments compared to banks or Western Union.

- Increased privacy, since you’re not sharing personal info with third parties.

Need to know:

- Transactions can’t be reversed, so double-check each transfer.

- Crypto values can fluctuate quickly, so timing matters.

- Web3 wallets require more setup, but they unlock access to the wider crypto ecosystem.

Key Features to Look for in Peer-to-Peer Money Transfer Apps

Not all peer-to-peer money transfer apps are built the same.

Choosing the right platform could mean smoother payments, lower costs, and fewer headaches down the line.

Here’s what matters most when picking an app, whether you’re sending a quick payment to a friend or managing business transactions with team members on three continents.

Secure and Reliable Transfers

Security should be the first box you check. Look for platforms that use end-to-end encryption and strong user authentication.

Reputable apps require two-factor authentication (2FA) for every important action, keeping your account safer from fraud.

You want your transfers to go through every time without technical hiccups or funds getting lost.

Transparent Fees and Exchange Rates

Nobody wants hidden fees draining their earnings. Go with platforms that highlight their fee structure up front before you send a payment.

Some apps charge nothing for domestic payments but add fees for international moves, instant deposits, or currency exchange.

Even a few dollars here and there can add up.

Speed of Transfers

Instant access to your money is more than a convenience; it’s often critical for business and everyday life.

Some apps move money in seconds, while others can take an hour, a day, or even longer for international transactions.

Broad Platform Support and User Experience

A good money transfer app should work comfortably on any device you use.

Whether you’re sending cash from a phone, laptop, or tablet, you should have full features at your fingertips.

Sending Limits and Account Controls

Every platform sets daily or monthly limits to manage risk.

If you need to send larger sums or handle high volumes of payments, pay attention to platform caps.

Some platforms let you raise your limit by verifying your identity or linking additional bank accounts.

International Access and Currency Options

Working globally or paying partners abroad? You’ll want a peer-to-peer money transfer platform that allows international payments and supports multiple currencies.

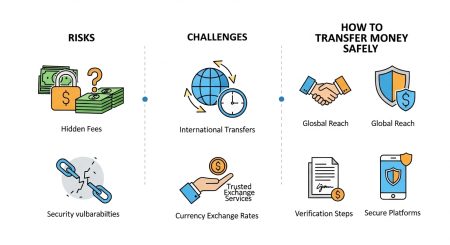

Risks, Challenges, and How to Transfer Money Safely

Peer-to-peer money transfer apps have opened up a world of fast, flexible payments.

But where there are opportunities, risks are never far behind.

From scammers fishing for quick cash to careless device habits that put your funds at risk, it pays to know the dangers and how to sidestep them.

Recognizing and Avoiding Scams: How to spot phishing, fraud, and suspicious activity in P2P payment platforms

Fraudsters love to take advantage of fast, irreversible payments.

Scams can take many forms fake payment requests, copycat websites, or phishing emails that look nearly real enough to fool anyone.

Watch out for these warning signs:

- Unsolicited payment requests: If someone you don’t know or trust asks for money out of the blue, be wary.

- Phishing links: Shady emails or texts may send you to lookalike login pages designed to steal your password.

- Misspelled usernames & odd emails: Real payment apps care about details; scammers often don’t.

- Pressure for immediate payment: Scammers want you to act fast and skip double-checking. Resist the rush.

Best Practices for Secure Transfers: Actionable advice on passwords, 2FA, and keeping devices secure

A few habits go a long way in keeping your money and data safe when using peer-to-peer money transfer platforms.

Make every move count by tightening up your security.

Here’s what you can do:

- Use strong, unique passwords: Choose a complex password, not something you use elsewhere. Password managers help keep track.

- Enable two-factor authentication (2FA): Always activate 2FA when the app offers it. A text code or authentication app adds a critical safety barrier.

- Keep your devices locked: Set up PINs, fingerprint, or facial recognition on phones and tablets. This stops others from getting into your apps.

Conclusion

Peer-to-peer money transfer puts control and speed back in your hands, helping freelancers, business owners, and global workers move money without hassle.

The best platforms combine security, transparent fees, and ease of use, making it easier to keep work and life moving.

Always compare your options and pay attention to privacy features so your funds and data stay safe.

By taking a moment to review available solutions and following safe transfer habits, you make every payment smarter and more reliable.