The best crypto arbitrage strategies help traders earn from small price gaps across exchanges while keeping risks under control.

Using the best crypto arbitrage methods is key for freelancers, businesses, and digital nomads seeking extra income through smart trading.

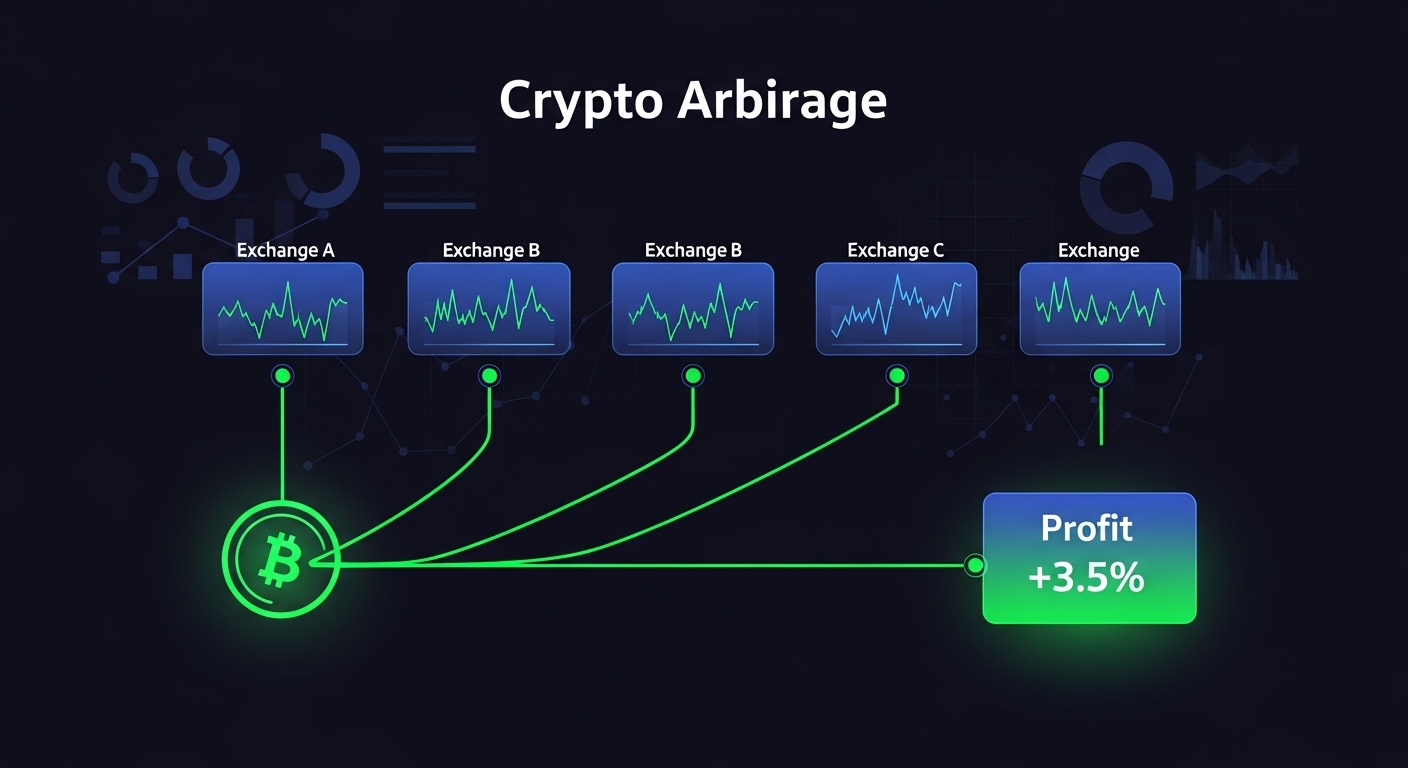

What is Crypto Arbitrage?

Crypto arbitrage allows traders to take advantage of price gaps across exchanges, turning small differences into consistent gains.

For freelancers, small businesses, and active traders, the best crypto arbitrage strategy makes digital payments more profitable and practical.

How Crypto Arbitrage Works

Crypto arbitrage works by buying cryptocurrency on one exchange at a lower price and selling it on another where it’s higher, creating quick profit opportunities.

The best crypto arbitrage strategies rely on speed and automation, since price gaps often disappear within seconds.

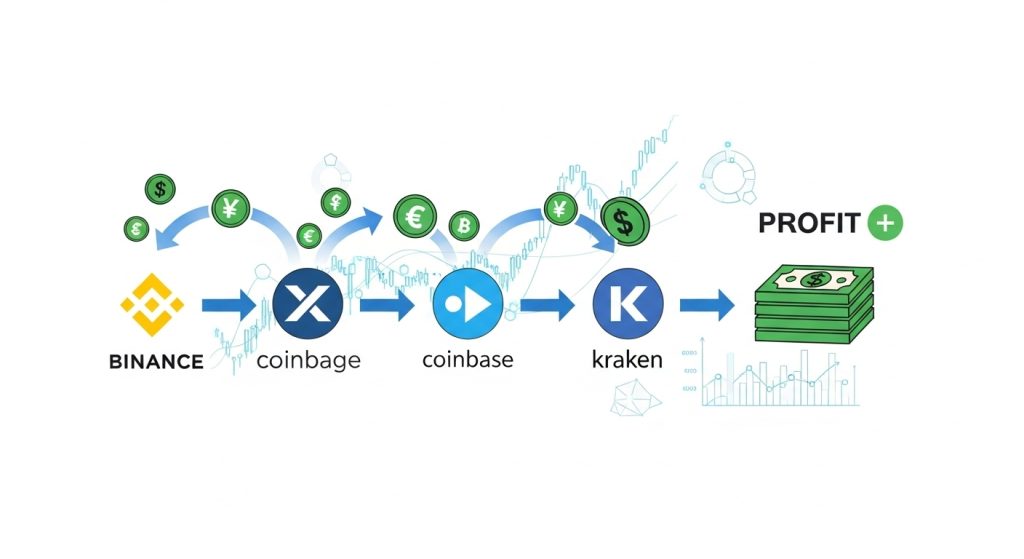

Common Types of Crypto Arbitrage

Crypto arbitrage can be done in several ways, each offering unique opportunities depending on the market setup.

The best crypto arbitrage strategies include centralized exchange trading, DEX opportunities, and multi-pair swaps for maximum profit potential.

Why Do Arbitrage Opportunities Exist?

Crypto arbitrage opportunities often appear because exchanges differ in liquidity, volume, and regional demand.

The best crypto arbitrage strategies take advantage of these temporary price gaps to generate consistent profits.

Key Considerations Before Adopting Crypto Arbitrage

Jumping into the world of crypto arbitrage can look easy, but having a plan is essential if you want to build steady gains and avoid rookie mistakes.

Before you start trading your way to the best crypto arbitrage strategy, pause and consider a few factors that often determine your results.

Understand Market Volatility

Crypto prices can jump up or down in seconds, and that volatility is both a blessing and a curse for arbitrage traders.

Quick profits depend on your ability to monitor prices in real time and act fast.

Account for Fees and Hidden Costs

Even a small difference between buy and sell prices can seem tempting, but fees can eat up those gains before you see them.

Network Speed and Blockchain Confirmations

Speed is everything with crypto arbitrage.

Some blockchains are quick, but others can take minutes or longer to confirm transactions. Network congestion can also slow things down.

If your transfer takes too long, the price difference might vanish before your coins even arrive.

Regulatory and Security Risks

Choosing the right platform is not just about price gaps; it’s about trust and safety.

Regulations differ by country, and not all exchanges have the same security standards.

Using an unregulated or unsafe exchange can put your funds at serious risk.

Capital Requirements and Liquidity

Arbitrage isn’t just about spotting an opportunity; you need enough capital to make the trade worth your time.

Most price differences are only profitable if you move meaningful amounts.

Automation and Timing

Manual arbitrage is possible, but automation increases your odds.

Many traders use bots to scan for opportunities 24/7 and act faster than any human could.

Of course, setting up bots requires technical knowledge and careful monitoring.

Tips to Maximize Arbitrage Profits and Manage Risks

When using the best crypto arbitrage strategy, knowing how to boost your profits and keep risks low is just as important as spotting price gaps.

Even the smartest strategy can come up short if you overlook the basics. Here’s how to give yourself an edge and shield your capital in a market that never sleeps.

Move Fast and Track Multiple Exchanges

Best Crypto arbitrage depends on speed.

Prices on different exchanges can sync up in seconds.

The faster you spot and execute trades, the better your profit chances.

Streamline Transfer Processes

Transfers between exchanges can slow you down and chip away at profit. Efficiency matters.

Use Automation and Bots Wisely

Manual trading will always be slower compared to bots.

Automated tools can spot, react, and execute trades in fractions of a second.

Always Calculate All Costs Before Trading

Paper profit can disappear fast after fees.

Don’t get caught by a hidden charge.

Diversify Your Arbitrage Approaches

Relying on a single method can expose you to sudden losses if conditions shift.

Rotate between several strategies.

Prioritize Security and Avoid Unknown Platforms

Security can make or break your profit goals.

If you lose your funds to a hack or shady exchange, even the best crypto arbitrage strategy is pointless.

Manage Capital and Limit Exposure

Chasing every small price gap can tempt you to overextend your capital.

Instead, focus on high-probability trades and never risk more than you can afford to lose.

Monitor Market and Regulatory Updates

Markets change quickly, and so do local rules affecting crypto. Stay up to date.

Keep Accurate Records for Taxes and Auditing

Arbitrage may involve dozens of trades, across many platforms and blockchains.

Good records help with taxes and make it easier to track which strategies maximize your profits.

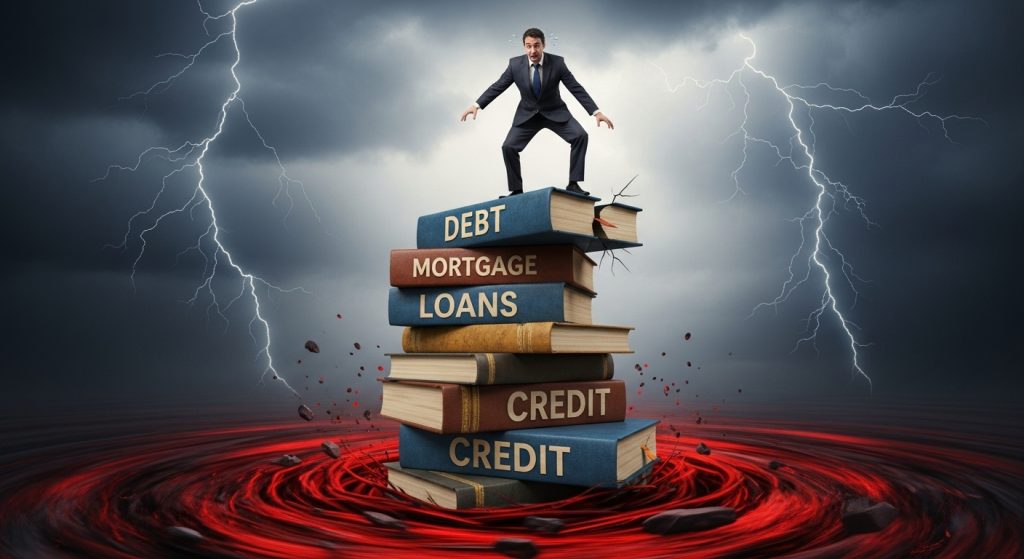

Common Pitfalls in Crypto Arbitrage

Using the best crypto arbitrage strategy can give you an edge, but even experienced traders can fall into common traps.

These mistakes can shrink your profits or even turn potential wins into costly losses.

Overlooking Transfer and Trading Fees

Small price gaps look attractive, but neglecting to account for all fees will often wipe out your gains.

Every transfer, trade, and withdrawal comes with a cost.

Slow Transfers Kill Opportunities

Timing is everything. Major blockchains can face congestion, and some exchanges take their time processing withdrawals.

Ignoring Market Volatility

Crypto is fast-moving and prices pivot on news, whale trades, or sudden trends.

Opportunities that look profitable can vanish in seconds.

Incomplete Regulatory Research

Jumping into new exchanges without checking rules or their legal status can freeze your funds.

Different countries and platforms have unique restrictions.

Trusting Unproven Exchanges

Too many traders jump at new platforms promising low fees or big gaps, only to face hacks or fraud.

Misconfiguring Trading Bots

Bots can multiply your effectiveness, but simple mistakes in setup, like wrong trading pairs or price limits, often lead to unexpected losses.

Over-Leveraging

Borrowing too much to increase trade size might look tempting, but it amplifies both wins and losses.

Sudden price moves can trigger big liquidations.

Neglecting Security Practices

Leaving large amounts online, using duplicate passwords, or skipping two-factor authentication puts your whole bankroll at risk.

Lack of Accurate Record-Keeping

Without detailed records, it’s easy to lose track of profits, fees, and even stolen assets during platform failures.

Relying on Unverified Information

Chasing tips from untrusted sources or social media can cost you real money.

Conclusion

Using the best crypto arbitrage strategy lets freelancers and business owners take charge of their financial growth in a fast-moving digital space.

By staying alert and using proven methods, you can make the most of small price gaps and turn them into steady gains.

Success in crypto arbitrage comes from planning, learning, and adapting as new tools and market changes appear.

Always prioritize strong security habits and stay updated on legal changes to protect your profits.