Finding the best arbitrage opportunities cryptocurrency traders trust is more relevant than ever.

Crypto arbitrage involves seizing quick profits from small price differences for the same coin across different exchanges.

What Is Cryptocurrency Arbitrage?

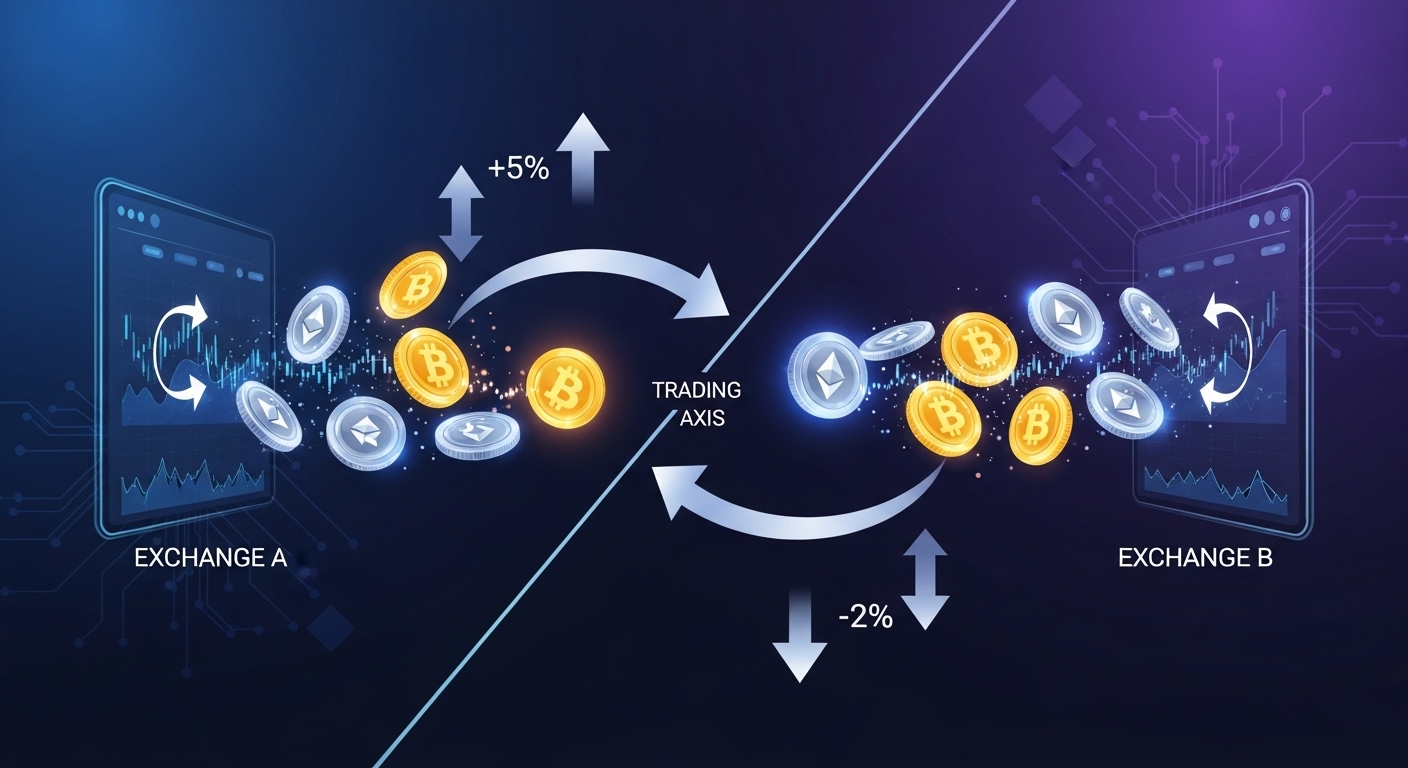

Cryptocurrency arbitrage is a strategy where traders exploit price differences for the same digital asset across multiple crypto exchanges.

Rather than holding on for long-term gains, you take advantage of tiny gaps in price that exist for a few minutes (or sometimes seconds) at a time.

How Cryptocurrency Arbitrage Works

When you check the price of Bitcoin or any other cryptocurrency, it often isn’t identical everywhere.

Each exchange sets its own prices based on supply and demand.

As a result, a coin might trade at $40,010 on one exchange and $40,200 on another.

Basic Steps Involved

Basic step involved in finding the best arbitrage opportunities

- Identify the price gap by quickly scanning multiple exchanges.

- Buy the cryptocurrency at a lower price.

- Transfer and sell on the exchange where the price is higher.

- Subtract transaction and transfer fees to find your net profit.

Why Do Price Gaps Happen Across Exchanges?

Not all exchanges have the same number of buyers and sellers at any given moment.

Some platforms may experience a surge in demand because of local news, market events, or even differences in fiat currency availability.

Key Factors Causing Price Differences

- Liquidity variations: Fewer buyers and sellers can mean more erratic prices.

- Geographic differences: Local regulations, fiat channels, or demand spikes.

- Technical delays: Lag in updating prices between exchanges.

Common Types of Crypto Arbitrage

The best arbitrage opportunities aren’t one-size-fits-all. Here are the main types most users try:

- Spatial arbitrage: Buying a coin on one exchange and selling it on another. This is the classic version.

- Triangular arbitrage: Involves three trades, swapping between different coin pairs to profit from pricing inefficiencies within a single exchange.

Tools and Tech for Crypto Arbitrage

- Arbitrage bots that monitor prices and act automatically.

- Price aggregator platforms that show real-time gaps.

- Portfolio organizers to track profits and losses.

Top Types of Arbitrage Opportunities in Cryptocurrency

Understanding the top strategies is key if you want to find the best arbitrage opportunities cryptocurrency traders rely on.

Let’s look at some of the main types you’ll see today. From traditional cross-exchange moves to advanced bot-powered plays..

Cross-Exchange Arbitrage

Cross-exchange in the best arbitrage opportunities is the bread and butter of crypto arbitrage.

This is where you buy a cryptocurrency on one exchange at a lower price and sell it on another exchange where the price is higher.

It sounds simple, but it requires speed, clear calculations, and a solid handle on transfer fees.

Key Requirements for Success

- Accounts on multiple reputable exchanges

- Quick and low-fee transfer options

- Tracking tools or bots for monitoring price differences

Triangular Arbitrage Within a Single Exchange

Triangular arbitrage focuses on price mismatches among three trading pairs on a single platform.

You cycle funds through three currencies (for example, BTC, ETH, and USDT), exploiting price differences, then return to your original coin.

Why Traders Like this Strategy

- No risk of slow or stuck blockchain transfers

- Fully automated trading is possible with the right tools

- Lower exposure to market swings between exchanges

Spatial and Cross-Border Arbitrage

Crypto’s global nature creates price gaps between regions, especially where demand spikes due to local regulations or limited fiat channels.

This strategy means buying crypto in a country where it’s cheap and selling it where it’s more expensive.

Considerations for Global Freelancers and Businesses:

- Legalities: Some regions restrict cross-border crypto flows. Always check regulations before moving funds internationally.

- Currency controls: Foreign exchange rules and bank limitations can affect transfers.

- Cybersecurity: Take extra steps to secure your accounts and wallets when moving funds between regions.

DeFi and DEX Arbitrage

Decentralized finance (DeFi) brings fresh types of arbitrage that don’t rely on traditional exchanges.

Here, traders use decentralized exchanges (DEXs) and liquidity pools.

Profits come from price differences between DEXs, or between a DEX and a centralized exchange.

What you’ll need:

What you will need for the best arbitrage opportunities

- A reliable Web3 wallet (like MetaMask)

- Knowledge of how to interact with DEX protocols (Uniswap, PancakeSwap, etc.)

- Strong understanding of liquidity pool mechanics and impermanent loss

- Tools to track real-time prices across platforms

Automated Bots and Statistical Arbitrage

The explosion of trading automation has transformed how the best arbitrage opportunities cryptocurrency enthusiasts pursue are found and executed.

Bots use AI and machine learning to scan prices, trade instantly, and manage huge volumes that humans can’t match.

Popular tools include:

- CryptoHopper

- 3Commas

- Gnosis Safe for DeFi strategies

Benefits of automation:

- Non-stop monitoring, even while you sleep

- Rapid reaction to tiny and short-lived gaps

- Easy scaling across multiple exchanges

Downsides:

- Initial setup costs and learning curve

- Risk of bugs or errors in trading logic

- Bots can get caught in sudden market crashes

Key Factors for Success in Cryptocurrency Arbitrage

Spotting the best arbitrage opportunities cryptocurrency markets offer takes more than just luck or a fast computer.

Profitable arbitrage requires careful planning, dependable tools, and a sharp sense for risk and timing.

Speed and Automation

Timing is everything. Cryptocurrency prices move in the blink of an eye, and arbitrage gaps close fast.

Manual trading simply isn’t enough for most people.

Most successful traders use bots to monitor multiple exchanges and act the moment a price difference pops up.

Accurate Fee Calculation

Even the best arbitrage opportunities cryptocurrency traders spot can turn into losses if you ignore fees.

Each trade comes with withdrawal charges, transaction fees, and sometimes blockchain network costs.

Break down all your costs first:

- Trading fees (exchange commissions)

- Withdrawal and deposit fees

- Blockchain transfer fees

- Slippage (price change between your click and the actual trade)

Exchange Choice and Liquidity

Trustworthy, high-volume exchanges are a must.

You want platforms where you can trade quickly, with little risk of orders getting stuck.

Low liquidity can trap your money or cause unexpected price swings.

Security and Fund Management

Arbitrage sometimes means moving funds between multiple wallets and exchanges in a short time.

Keep your funds secure at every stage.

Use two-factor authentication, solid passwords, and separate wallets for trading and savings.

Risk Management Practices

Every trade carries risk, no matter how smart or fast you are.

Fees can increase, networks slow down, or coins pump unexpectedly.

Define your rules before you place a trade.

Continuous Learning and Adaptability

Crypto never stands still. What worked last year can fail tomorrow.

The best arbitrage opportunities cryptocurrency traders find come from a willingness to learn new techniques, tools, and regulations.

Risks and Challenges of Crypto Arbitrage

Crypto arbitrage may sound like easy money, but it comes with risks that every trader needs to respect.

The best arbitrage opportunities cryptocurrency markets offer can turn bad quickly if you ignore the pitfalls. Savvy users need to weigh these risks before moving large sums or relying on automation.

Here’s what can go wrong, and why caution pays off.

Exchange and Withdrawal Delays

Transferring coins between exchanges isn’t always instant.

Sometimes, network congestion or strict security protocols can hold up your withdrawal for hours, or longer.

While you’re waiting, the price gap might close, turning a “sure thing” into a loss.

Volatile Market Price Swings

Crypto prices can whipsaw before you finish a transaction.

By the time your funds land at the selling exchange, the opportunity may be gone, or worse, you could be forced to sell at a loss.

This is why many traders avoid arbitrage with highly volatile coins, focusing instead on pairs that show more price stability.

Fee Surprises and Hidden Costs

Fees are the silent killer of arbitrage profits.

Between trading, withdrawal, deposit, and sometimes network fees, your expected gains can vanish.

New traders often overlook small charges that add up fast, especially on exchanges with higher fee structures.

Liquidity Traps

If an exchange has thin order books, you may not be able to buy or sell at the price you expect.

Placing a large trade on a low-liquidity exchange can push the price against you, triggering slippage and reduced profits.

Security and Counterparty Risks

Moving funds between exchanges puts your assets at risk of hacking, phishing, or platform failure.

Not every exchange is safe, and new or lesser-known platforms often lack solid protections for users.

If a platform is compromised while you’re trading, there’s a real chance of loss.

Regulatory and Legal Challenges

Cross-border crypto movements can trigger legal headaches no matter your intent.

Some countries restrict crypto transfers altogether, while others require special declarations or taxes.

Failing to understand regulations puts your funds and possibly your accounts in danger.

Technical Glitches and API Errors

Automated bots rely on accurate data feeds and solid APIs.

If your bot misreads a price, lags, or faces downtime, mistakes happen.

Misplaced or duplicated orders, missed opportunities, or large losses can result.

Scam Exchanges and Fraudulent Activity

High returns sometimes attract shady operators.

Fake exchanges, phony arbitrage “tools,” and bad actors are common.

Checking resources like the PayApeer blog can help you spot red flags and get honest reviews.

How to Get Started With Crypto Arbitrage Safely

Jumping into crypto arbitrage can feel like standing on the edge of a busy highway exciting, fast, and a little bit overwhelming.

There’s big potential, but also plenty of risk if you move too quickly.

Here’s a clear path to get started with crypto arbitrage safely, especially if you want to take advantage of the best arbitrage opportunities cryptocurrency markets offer right now.

Learn the Basics and Common Risks

Before chasing after quick profits, take time to truly understand crypto arbitrage.

Study how pricing works, what causes gaps between exchanges, and why timing is everything.

New traders often underestimate the impact of fees, transfer delays, and sudden market shifts.

Set Up Accounts on Multiple Trusted Exchanges

You’ll need verified accounts on at least two secure, reputable exchanges.

Pick platforms with strong liquidity, low fees, and quick withdrawal options.

Choose the Right Crypto Pairs and Market

Focus on liquid, well-known cryptocurrencies first.

These coins tend to have tighter spreads, faster transfers, and less price slippage.

Sticking to pairs like BTC/USDT or ETH/USDT lets you practice safely and understand true profit margins without wild price swings.

Calculate All Your Fees Upfront

Traders often forget about or underestimate hidden costs.

These include trading fees, deposit and withdrawal charges, and blockchain transaction fees.

Even the best arbitrage opportunities cryptocurrency veterans find can be wiped out by high costs.

Start Small to Test Your Strategy

Kick things off with small amounts to test your plan in real time.

This protects your funds while allowing you to spot issues with timing, liquidity, and hidden fees you may have missed.

As suggested by this beginner’s guide to crypto arbitrage, making small trades not only keeps risk low but also builds your experience and confidence.

Use Automation Tools Wisely

Automated trading bots help monitor prices and execute trades rapidly.

Consider starting with basic alert tools before graduating to full automation.

This reduces the learning curve and gives you time to understand the tech.

Protect Your Crypto and Personal Data

Security is as important as speed.

Use two-factor authentication on all accounts, create strong passwords, and never share API keys unless you fully trust the tool.

Only move amounts you’re willing to lose. Regularly check your account history and balances for suspicious activity.

Track Your Results and Adjust

Keep records of every trade, including profits, losses, and fees.

Take notes on what works best and where delays or issues appear.

Use this data to refine your strategies, narrow down top exchanges, and manage risk effectively.

Stay Informed and Keep Learning

Crypto moves fast, and what works today might not work next month.

Regular checks of market news, exchange policies, and pricing tools make a big difference.

For ongoing tips and detailed safety advice, explore this reliable guide on crypto arbitrage strategies.

Finding the Best Arbitrage Opportunities in Cryptocurrency

Scouting out the best arbitrage opportunities cryptocurrency traders want in 2025 means staying alert, using the right tech, and knowing where to look.

Price gaps are getting tighter, yet new tools and expanding global access make it possible for more people to join the action.

Staying Ahead with Real-Time Tools

Automated scanners and price tracking bots are your best friends for spotting fleeting gaps.

Most big moves are gone in seconds, so using well-reviewed tools is the foundation of successful crypto arbitrage today.

Choosing the Best Exchanges

Not all exchanges offer the same value or safety.

The ideal exchanges for arbitrage have high liquidity, low fees, and fast transaction times.

Slow verification or withdrawal delays can ruin an otherwise perfect trade.

Exploring New Types of Arbitrage

Global regulations and tech are shifting.

The best opportunities now often pop up in fresh or unexpected places, like decentralized finance (DeFi) platforms and cross-border markets.

Arbitrage between regional exchanges with local demand spikes sometimes offers bigger spreads, especially in emerging markets.

Harnessing Communities and Alerts

Crypto communities, forums, and live Telegram or Discord groups still play a role when searching for the best arbitrage opportunities cryptocurrency users might miss.

Crowd-sourced alerts can point out new market inefficiencies, uncover bugs, or flag flash sales on little-trafficked exchanges.

Conclusion

Crypto arbitrage still offers real profit potential in 2025, but grabbing the best arbitrage opportunities cryptocurrency markets give now takes more skill and preparation than ever.

Traders who see the most consistent gains invest in robust automation, fast tools, and strong risk controls.

For freelancers, growing businesses, and global remote workers, dipping into crypto arbitrage makes sense when you value speed, flexibility, and the chance to boost your digital payment skills.